The lifeline of any business is its cash flow. But, long payment cycles and late payments choke functioning and stall growth. The solution to these issues are invoice financing—it is designed to bridge the cash flow gap by turning unpaid invoices into capital.

Be it a small enterprise or a growing corporation, leveraging a TReDS platform (Trade Receivables Discounting System) for TReDS invoice financing allows access to quick funds without affecting your balance sheet.

What Is Invoice Financing?

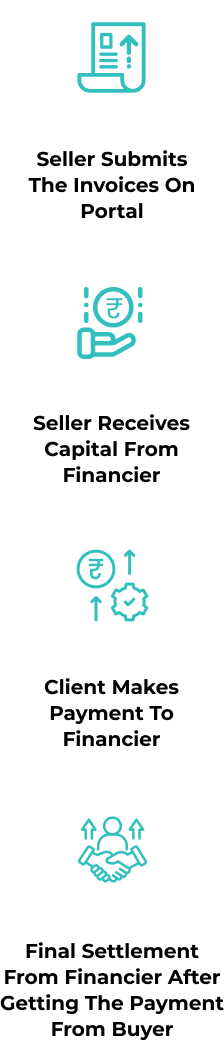

Invoice financing is a funding solution that empowers businesses to get access to cash on their outstanding invoices. Instead of waiting for clients to clear their bills (30, 60, or even 90 days later) sellers can sell unpaid invoices to a financier and receive up to 90% of the invoice value upfront. Once the client pays, sellers receive the remaining balance minus a small financing fee.

How Does Invoice Financing Work?

Invoice Financing The Best Aid Of MSMEs

For MSMEs, cash flow is everything. RBI-regulated TReDS platform, with just a few clicks, automates financing, reduces paperwork, and brings in transparency. Sellers can easily avoid the risk of delayed payments by selling invoices and get cash flow and better financial predictability. Invoice financing ensures MSMEs get immediate cash flow without waiting for long payment cycles. Contrary to traditional loans, TReDS invoice financing doesn't drown you in debt. It is similar to getting an advance on the revenue already earned. This ensures smooth operations, inventory replenishments, and expansion without any debt or worry.

TReDS Invoice Financing: A Smarter Solution For MSMEs

TReDS platform (Trade Receivables Discounting System) is RBI-regulated marketplace that brings MSMEs, financiers, and enterprises on one platform. Through TReDS businesses receive competitive funding rates in a transparent way.

Who Benefits From Invoice Financing?

MSMEs & Startups

Manufacturers & Suppliers

Service Providers

Invoice financing helps businesses get immediate funds for functioning. So, why wait? Explore invoice financing today and grow your business further!